How Veygo’s AI Assistant does the work of 4 contact centre agents.

Veygo Insurance (part of the Insurance giant, Admiral Group) is dedicated to helping drivers get behind the wheel whenever they want through flexible, temporary, comprehensive insurance cover.

Veygo was a victim of its own success; a hugely popular service for new, temporary, and learner drivers, their Contact Centre faced consistently high numbers of repetitive enquiries that were inefficient to handle manually through their primary channel, email.

Veygo identified that AI Assistants could potentially alleviate pressure on their teams, and help them analyse customer behaviour to continually improve the customer experience.

They began searching for a cost effective, easy to use platform that could facilitate self-serve in multiple languages across multiple channels and provide detailed user analytics. They chose Logicdialog.

Logicdialog x Veygo

After a quick implementation, most straightforward customer requests (aka low hanging fruit) were automated, meaning Veygo now had user data they could assess to decide their next move. That ‘next move’ was to automate some of the more complex enquiries to drive further operational efficiencies. It worked! Logicdialog and Veygo are now planning to use the recorded success metrics to build a business case for deeper integrations.

Note: A quick note on monitoring success (it’s not as straightforward as you might think!). ‘Success’ is counted if a customer confirms the AI Assistant’s answer is satisfactory (they do this by hitting the 👍 emoji or saying something like ‘yes’ or ‘thanks’), or if the customer exits the conversation without requesting further assistance - and doesn't return for further assistance on the same topic within 24 hours. All figures are based on this definition of success and are as accurate as they can be using this common approach in the world of AI assistants.

The numbers

Veygo’s AI Assistant currently handles around 10,500 customer interactions a month. About 6,300 of those interactions are straightforward requests for general information, and are successfully handled around 80% of the time by the AI Assistant.

This means that 5,040 less enquiries come into the contact centre each month. These kinds of requests used to take around 2 minutes to resolve manually, meaning Logicdialog saves Veygo 10,080 minutes (or 168 hours) a month on simple enquiries.

The remaining 4200 interactions with Veygo’s AI assistant are more complex, meaning around 60% can be fully automated, and the remaining 40% still need some form of manual contact centre support. Which means around 2520 enquiries don’t need that human touch, and with these enquiries estimated to take 6 minutes to resolve manually, Logicdialog saves Veygo a further 15,120 minutes (252 hours) a month.

All in all, it’s estimated that Logicdialog saves Veygo around 420 hours a month. Not bad, but what does that mean in terms of increased efficiency?

Industry benchmarks

An agent utilisation rate (the % of time agents spend on calls/emails) of 70% is fairly standard. And it’s widely recognised that a working week in the UK is 35 hours. There are on average 4.3 weeks in a month.

All of which equates to 105 productive hours in a month (35 x 4.3 x 0.70). Dividing the hours saved by the number of productive hours in a month means Logicdialog is handling the work of around 4 agents. At an average salary of £25,000 a year, this equates to £100,000 of efficiency gains. But there’s more…

The concept of ‘fully loaded’ costs relates to the cost associated with serving customers when you account for all costs, including:

Sickness and Unplanned Absence

Work Equipment

Employee Pension Contributions

Recruiting a Customer Service Representative

Getting your Contact Centre Agent up to speed

Staff Turnover

Holidays

Equipment and Space…

Fully loaded costs add approximately 35% to an employees salary figure, meaning the true cost (to the business) of an agent earning £25,000 is around £33,750.

Estimated ROI

Based on these full loaded costs and the agreed definition of ‘success’, Veygo’s AI Assistant drives around £135,000 in productivity for the Insurance firm each year. That's an ROI ratio of nearly 1:7 - and there’s still more that could be done.

“We were particularly impressed by its simplicity, enabling us to customise the digital assistant without extensive technical expertise. Overall, the Logicdialog platform has proven user-friendly and readily deployable.”

A word from the customer

Kevin Tardy, Veygo’s Operational Excellence Lead, said of Logicdialog:

“Our experience with Logicdialog has been exceedingly positive,” said “We appreciate having a single point of contact for support, along with regular updates and swift responses to data-related queries.”

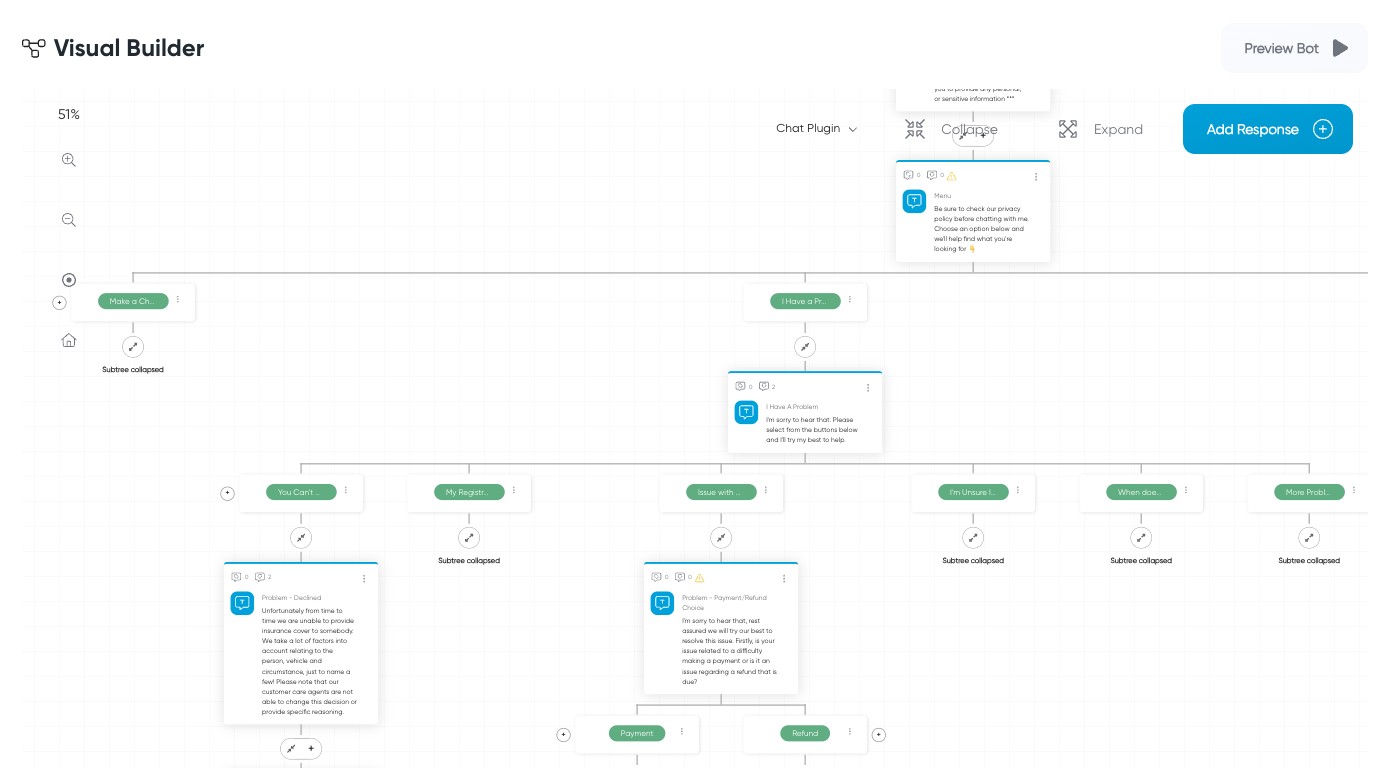

“The platform's visual builder is intuitive, requiring no extensive IT knowledge for operation,” he continued. “We were particularly impressed by its simplicity, enabling us to customise the AI assistant without extensive technical expertise. Overall, the Logicdialog platform has proven user-friendly and readily deployable.”

Future plans

Logicdialog has become an integral part of Veygo’s customer service strategy, and the partnership is poised for future growth and innovation. Moving forward, Veygo is looking at deeper system integrations, and Generative AI to further push the envelope in the name of customer service excellence. The relationship so far has been one of iteration, joint learning, collaboration and joint success, and it’s exciting to see how the partnership develops as the insurance industry (like all industries) further adopts AI.

Bot bytes:

ROI: £135,000 per year

Hours saved each month: 420

About Veygo

Launched in 2016, Veygo is changing the world of car insurance, providing flexibility for different types of lifestyles. It’s sold over 4 million policies since launching, and continues to help learner drivers and card drivers get on the road with short-term car insurance.